How I Handle the Urge to Buy Things for My Kids

You can resist buying everything your kids want by implementing a simple 30-day waiting period—snap a photo of the item, then revisit it after a month to see if they (or you) even remember it. Most of the time, the urge fades completely, saving you money and teaching them patience. Create a dedicated “kids’ wants” budget category (around 5-7% of your income) so the budget becomes the boundary, not your guilt. The one-in-one-out rule for toys keeps clutter manageable while teaching resource awareness, and redirecting those “gimme” moments into planning fun experiences—like exploring new parks or hosting themed nights at home—builds stronger memories than any toy ever could. There’s actually a whole framework for turning these everyday choices into powerful life lessons.

Key Takeaways

- Practice the 30-day waiting period for non-essential purchases by photographing desired items and reassessing interest after a month.

- Distinguish between needs and wants by asking if the item will be used next month before buying.

- Create a dedicated budget category for children’s wants, allocating 5-7% of take-home pay for guilt-free discretionary spending.

- Implement a one-in-one-out rule where buying something new requires donating or removing an existing item.

- Redirect purchase requests to birthday lists and focus on creating memorable experiences through free community resources and family activities.

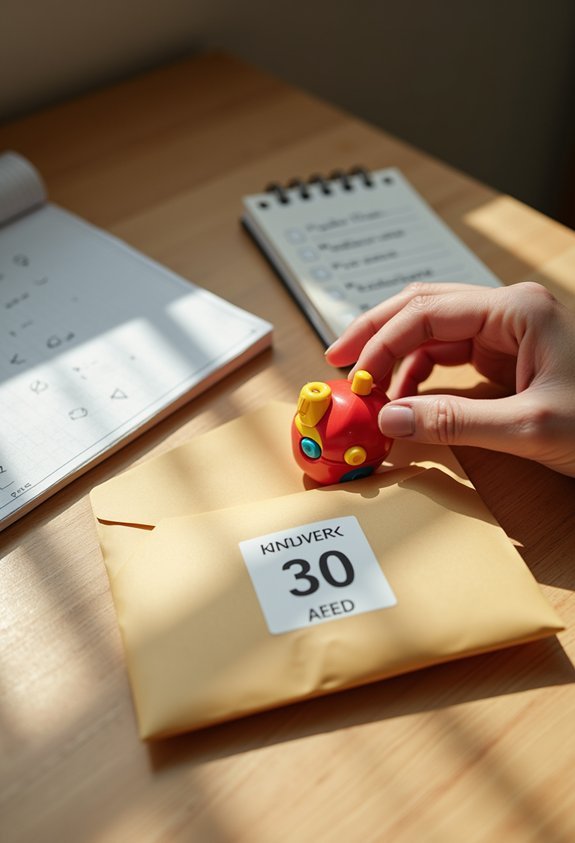

Implementing the 30-Day Waiting Period Before Any Non-Essential Purchase

When your kid locks eyes on that must-have toy in the store aisle, the pressure to say yes can feel absolutely overwhelming—especially when they’re giving you those puppy-dog eyes that could melt steel.

Here’s your secret weapon: the 30-day rule.

Snap a photo of the item, save it to your phone, and tell your kid you’ll revisit it in a month. This simple pause disrupts those emotional triggers that make us grab our wallets without thinking.

Nine times out of ten? They’ll completely forget about it.

(And you’ve just saved money while teaching mindful spending.)

If they *still* want it after 30 days, it might actually be worth considering.

Plus, you’ve bought yourself time to shop sales—or discover they’ve already moved on to the next “must-have” thing.

This creates friction between desire and purchase, giving both you and your child space to determine whether the item is a genuine need or just a passing impulse.

Creating a Realistic Family Budget With a Dedicated “Kids’ Wants” Category

That’s where a “Kids’ Wants” budget category becomes your new best friend.

Look, you’re going to buy stuff for your kids—that’s just reality. So instead of feeling guilty every single time, plan for it like an actual adult (we’re trying, anyway).

Set aside a specific amount each month. Maybe it’s $50, maybe it’s $150—whatever works for your family savings situation without causing a minor panic attack.

Here’s the beautiful part: once you’ve got dedicated budget categories for this, you can say “yes” guilt-free when there’s money left.

And when it’s gone? The budget becomes the bad guy, not you.

“Sorry kiddo, the fun money‘s tapped out this month.”

Much easier than explaining why Mom impulse-bought that thing yesterday but can’t today.

Consider setting a cap on total discretionary spending at 5–7% of take-home pay to keep your family’s wants budget sustainable without derailing other financial goals.

Teaching My Children to Evaluate Needs Versus Wants

Your seven-year-old doesn’t need that LED fidget spinner—she wants it. This distinction matters more than you think because teaching value assessment now saves everyone from Future Meltdown City (population: your entire household).

I started simple. “Will you use this next month?” Works like magic for decision making skills—and suddenly, half the cart empties itself.

Here’s my favorite trick: let them choose between two wants. Real-world practice without the financial carnage. They’ll debate themselves into exhaustion, weighing pros and cons like tiny economists.

The best part? They’ll start self-regulating. My son now talks himself out of impulse buys better than I do.

The ultimate win: watching your kid put something back on the shelf without you saying a single word.

It’s not about deprivation—it’s about building brains that can think critically about shiny things. I also help them understand the difference between survival and stability needs versus comfort-driven wants, which creates a foundation for smarter choices throughout their lives.

Establishing a One-In-One-Out Rule for Toys and Clothes

Before you bring home that new race car set, something old has to go—and I promise this rule will change your life more than Marie Kondo ever could.

Here’s how it works: one new toy arrives, one old toy leaves. Simple math, revolutionary results.

Your kids will actually *see* what they own instead of drowning in plastic chaos. We’ve made it fun with toy rotation—storing half their stuff away, then swapping things out like it’s Christmas morning every few weeks.

Same goes for clothes. Those jeans they’ve outgrown? Perfect for clothing swaps with other families (free wardrobe refresh, anyone?).

The best part? Your kids learn that space—and money—aren’t infinite resources.

The shift from “where can I store this?” to “what will this replace?” helps children develop conscious consumption habits from an early age.

It feels strict at first, but trust me, less really is more.

Finding Free and Low-Cost Alternatives to Store-Bought Entertainment

While toy stores blast their siren song of “new, new, new,” the truth is that kids don’t need another $40 playset to have fun—they need imagination, and that’s gloriously free.

Your local library isn’t just books anymore—it’s storytimes, craft sessions, and sometimes even toy lending programs. Community resources like parks, splash pads, and free museum days become entertainment goldmines when you actually use them.

Libraries and parks aren’t backup plans—they’re treasure troves of free fun hiding in plain sight.

At home, creative play thrives on the weird stuff: cardboard boxes transform into spaceships, blanket forts become kingdoms, and that drawer full of random craft supplies (we all have one) becomes an art studio.

The irony? Kids often abandon the expensive toy for the box it came in anyway.

Resisting the urge to buy more actually reduces the cognitive load that comes from managing, organizing, and maintaining an overwhelming number of possessions.

Your wallet—and their creativity—will thank you.

Using Birthdays and Holidays as the Primary Gift-Giving Occasions

The random Tuesday toy demand—that’s the budget killer most parents don’t see coming.

You’ve got to make birthdays and holidays the main event. When your kid asks for something on a random Wednesday, you can say, “That’s perfect for your birthday list!” This simple redirect does two things—it validates their want without opening your wallet immediately.

Here’s how to make these occasions count:

- Create birthday traditions like a special breakfast or choosing the day’s activities

- Focus on holiday experiences rather than just presents (cookie decorating, anyone?)

- Keep a running list on your phone so you remember what they actually wanted

This approach teaches patience and makes gift-giving moments genuinely exciting. Adding items to a wishlist instead of buying immediately helps reduce emotional spending since the waiting period allows time for reflection on whether it’s truly necessary. Plus, you’re not hemorrhaging money every time you hit Target.

Practicing Gratitude Exercises to Shift Focus From Wanting to Appreciating

Kids who practice gratitude don’t whine less—they just want less, which is honestly the parenting win we’re all chasing.

You can start simple with gratitude journaling—even just three things they’re thankful for before bed. It doesn’t need fancy notebooks or Instagram-worthy spreads (though go ahead if that’s your thing).

The magic happens when appreciation becomes automatic.

Try mindfulness practices during car rides: what made today good? What’s something they already own that they love? These little check-ins rewire their brains from “I need that” to “I have enough.”

And here’s the secret—you’ve got to model it too. When you catch yourself wanting something, say it out loud: “I’d love new shoes, but my current ones still work great.”

They’re always watching.

When you practice mindful spending yourself, you’ll find that your desire for material possessions naturally diminishes, and your kids will notice that shift too.

Redirecting Shopping Urges Into Quality Time and Meaningful Experiences

When that “gimme” moment hits at Target, you’ve got about fifteen seconds before it escalates—so here’s your move: redirect that energy into planning something fun together instead.

Quality experiences beat another toy that’ll end up under the couch (we’ve all been there). When your kid begs for something, say: “Let’s save that money for our next adventure!”

Try these family adventures that cost less than toy shopping:

- Pack sandwiches and explore a new park or hiking trail

- Plan a “yes day” where your kid chooses free activities all afternoon

- Create theme nights at home—build blanket forts, camp indoors, host game tournaments

The memories stick. The plastic doesn’t.

Plus, you’re teaching them that fun doesn’t require a shopping cart. Before adding anything new to your home, take a moment for mindful purchasing by pausing to assess whether it truly adds value to your family’s daily life.

In case you were wondering

How Do I Handle Grandparents Who Frequently Buy My Kids Things?

You should have an honest conversation with grandparents about gift communication and your family’s values. Practice boundary setting by suggesting alternatives like experiences or contributions to savings, while appreciating their generosity and maintaining respectful relationships with them.

What if My Child Feels Left Out Compared to Peers?

You should address peer pressure by building your child’s emotional intelligence. Help them understand their feelings, recognize what truly matters beyond possessions, and develop confidence in their own worth rather than comparing themselves to peers’ material goods.

How Do I Resist Impulse Buying During Checkout Lines?

Use checkout strategies like choosing self-checkout lanes or online ordering to avoid temptation displays. Practice mindful spending by keeping a shopping list on your phone and asking yourself if each item serves a real need before purchasing.

Should I Give My Kids an Allowance or Earnings System?

You’ll find allowance benefits teach budgeting naturally, while an earnings system provides stronger earnings motivation through work-reward connections. Consider combining both approaches—base allowance for basic expenses, plus earning opportunities for extra money through chores.

How Do I Deal With Guilt About Saying No?

You’re not damaging your kids by saying no—you’re teaching them resilience. Effective guilt management means recognizing that strong parenting boundaries actually show love. You’re preparing them for real life, not depriving them of happiness.

Conclusion

You’ve got this—and honestly, your wallet will thank you later when those impulse purchases stop sneaking into your cart like tiny, expensive ninjas. The real treasure isn’t wrapped in plastic packaging anyway. It’s in those moments when you’re building blanket forts instead of browsing toy aisles, creating memories that’ll stick around long after that trending gadget ends up buried in the closet. Your kids don’t need more stuff; they need you present, engaged, and teaching them that happiness doesn’t come with a price tag.