The 30-Day Rule That Stopped My Impulse Buying Forever

You probably don’t overspend because you’re reckless—you overspend because your brain loves instant rewards. The 30-Day Rule interrupts that cycle with one simple constraint: you can’t buy any non-essential item until it’s sat on a written waitlist for 30 days. No exceptions in the moment, no emotional loopholes. It sounds restrictive, but the data you’ll gather on your own habits—and what happens to your money next—might surprise you.

What the 30-Day Rule Actually Is

At its core, the 30-day rule is a structured waiting period: before you buy any non-essential item above a set dollar amount (for example, $50 or $100), you write it down, walk away, and wait 30 days before deciding.

This rule creates friction between desire and purchase, so you spend deliberately. You log each potential buy, date it, and revisit it after the waiting period. If it still matters, you budget for it; if not, you delete it.

Over time, this builds financial discipline: fewer unplanned transactions, lower credit-card balances, and more cash for priorities like debt payoff or savings. You also spot patterns in your list—stores, categories, price points—so you can set tighter triggers (for instance, “anything over $40”) and refine your rules.

Why Impulse Spending Happens in the First Place

Even when you know better, impulse spending happens because powerful psychological and environmental triggers push you toward fast rewards and away from long-term thinking.

You’re wired to prioritize immediate pleasure; brain imaging shows the reward center lights up within seconds of seeing something you want. Emotional triggers—stress, boredom, even celebration—push you to buy relief instead of solving the root problem.

Smart marketing tactics amplify this. Retailers use scarcity warnings, flash sales, and free shipping thresholds to create urgency and fear of missing out. Apps remove friction with one-click checkout and stored cards, so you spend before you reflect.

Social media adds constant comparison, making “normal” spending creep upward until unplanned purchases feel justified, even responsible. Understanding these forces lets you redesign your spending environment.

How to Set Up Your Own 30-Day Waitlist

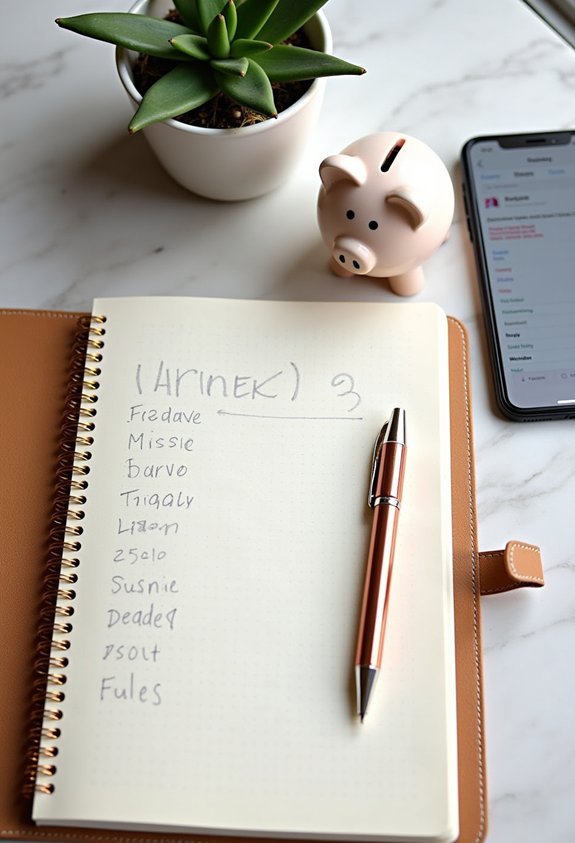

One simple system turns the 30-day rule from a vague idea into a habit you actually follow: a personal “waitlist” for every non-essential purchase. Start by choosing one capture tool—notes app, spreadsheet, or notebook—and label it “30-Day Waitlist.”

Each time you want to buy, log the item, price, store, and date. That’s your waitlist essentials kit. Then rank entries by impact on your life; you’re setting priorities, not punishing yourself.

- Picture a clean, single-page list replacing dozens of open shopping tabs.

- Picture a calm pause at checkout as you open your waitlist instead of your wallet.

- Picture your balance growing while low-value items quietly expire off the list.

Review it weekly and delete anything that no longer feels genuinely useful anyway.

What to Track During the 30 Days (And Why It Matters)

While the item sits on your 30-day waitlist, you’re not just “waiting”—you’re collecting data on your own behavior.

Track four things: date added, price, context, and feelings. Write where you were, what you were doing, and what triggered the urge to buy. Note emotional triggers like stress, boredom, or social pressure.

Record how often you revisit the item; frequent checking signals a stronger pull. Once a week, review your list and tag each entry as need, want, or impulse.

You’ll start seeing patterns in your spending habits: certain stores, times of day, or moods. This evidence turns vague guilt into clear information, so you can adjust your environment, set better rules, and reduce future impulse decisions.

Over time, your waitlist becomes a spending lab.

Real Results: How My Spending and Savings Changed

Thirty days of tracking produced changes I could actually measure: my impulse purchases dropped by about 60%, and my average monthly credit card bill fell by just over 20%.

You’ll likely see similar shifts once your spending patterns are visible in black and white. Non‑essential buys stand out, and you start questioning whether each “want” deserves space in your budget.

Within two months, my checking account stopped hovering near zero and a dedicated savings transfer became realistic. The same data that exposes leaks also quantifies your savings growth, which keeps you engaged.

- Your cart: fewer random add‑ons, more intentional upgrades

- Your statements: shorter, easier to scan for waste

- Your accounts: balances trending upward week after week so you see progress clearly

Tips, Exceptions, and Making the Rule Stick Long-Term

Anyone who wants the 30‑day rule to work long‑term needs a clear playbook: simple guardrails, defined exceptions, and systems that run on autopilot as much as possible.

Start by tying the rule to your budgeting strategies: every potential purchase gets labeled need, want, or upgrade, then scheduled on a 30‑day calendar. Track spending triggers with a quick log: time, mood, place, item.

Review weekly and design frictions—delete saved cards, unsubscribe from promo emails, remove shopping apps from your home screen.

Set explicit exceptions: true emergencies, health, work tools that protect your income, and pre‑planned purchases already in your budget. Even then, apply a 24‑hour pause.

Finally, automate transfers to savings on payday so delayed purchases translate into visible progress; you’ll reinforce the habit loop.

Conclusion

When you follow the 30‑day rule, you give every purchase a cooling-off period, like a safety lock on your wallet. You track the item, cost, date, and reason, then review the list weekly. That simple system can cut impulse buys by the majority and redirect hundreds of dollars a month to goals you actually value. Start your waitlist today, stick to the rule, and let the numbers prove your new spending habits this year ahead.