How I Learned to Walk Away From a ‘Good Deal’

You probably know the feeling of grabbing something on sale, only to find it sitting unused months later—like a 70% off gym membership you never activated. Behavioral economists call this “deal bias,” and it quietly drains your time, money, and attention. When you start treating every offer as an experiment instead of a victory, the definition of a “good deal” changes—and so do your choices.

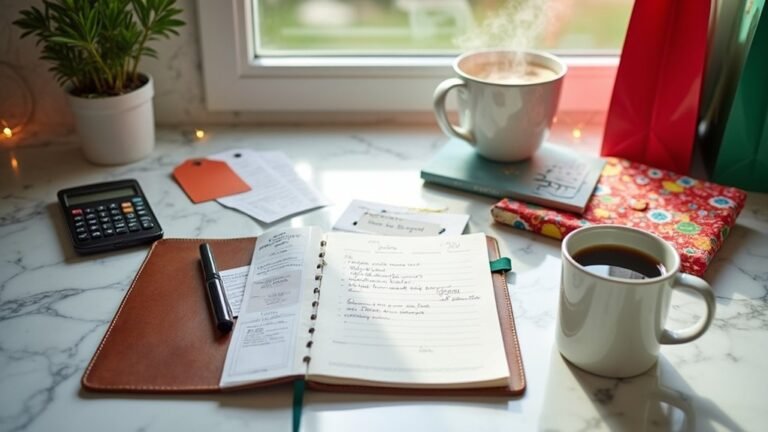

The Hidden Cost of Chasing Every Bargain

Although scoring a discount can feel like a win, research shows that constantly chasing bargains often erodes your time, attention, and decision quality in ways that outweigh the savings.

Behavioral economists call this bargain blindness: you overweight the visible markdown and underweight hidden costs like delays, stress, and opportunity loss.

Lab experiments on “deal framing” show that when you see a red sale tag, you’ll spend longer comparing options, yet end up less satisfied and more likely to regret your choice.

Field studies on coupon users find similar patterns: you travel farther, buy more extras, and ignore better base prices elsewhere.

Effective value assessment means asking, “What’s the total cost in money, time, and energy—not just the discount?”

Otherwise, small deals quietly control you.

When “smart on Paper” Feels Wrong in Your Gut

Even when a deal checks every rational box—great price, solid quality, glowing reviews—your stomach can still tighten in quiet refusal. Instead of dismissing that signal as irrational, treat it like data you haven’t decoded yet.

Your gut instinct isn’t magic; it’s fast pattern recognition built from thousands of past outcomes, filtered through your biases. You can run a quick internal experiment: pause, label what you’re feeling, then ask, “What exactly seems off?”

Maybe the seller pressures you, the return policy feels vague, or something in the story doesn’t match the numbers. By combining emotional intelligence with simple checks—sleeping on it, comparing options, or forecasting regret—you test whether discomfort protects you or merely repeats outdated fears.

Track these moments; patterns will sharpen your future decisions.

Untangling Value From Your Personal Values

Once you separate “market value” from your own values, many “can’t-miss” deals lose their shine.

You stop asking, “Is this cheap?” and start asking, “Is this consistent with who I am?”

A practical way to test value alignment is to run small experiments. Say yes temporarily, track your stress, sleep, focus, and relationships for 30 days.

Compare that data with the financial upside. If the numbers rise while your well‑being metrics fall, the deal’s price includes your personal integrity.

You’re also fighting cognitive biases: scarcity (“I’ll never get this chance again”), sunk cost, and status signaling. Naming them reduces their power.

Over time, you build an internal dashboard where profit is just one metric, not the overriding command.

That shift makes walking away rational.

The Questions I Now Ask Before Saying Yes

How do you stress‑test an opportunity before it quietly takes over your life?

You treat each offer like an experiment, not a destiny. Before you say yes, you run the same small set of questions, so your decision making strategies become repeatable rather than emotional one‑offs.

Ask yourself:

- Does this align with my stated priorities, not just my current mood?

- What objective metric will tell me, after three months, if this was worth it?

- What am I saying no to in time, focus, and energy, specifically?

- How would I advise a friend who was evaluating opportunities like this one?

- If this disappeared tomorrow, would I feel relieved or disappointed?

Track outcomes, update your questions, and let data, not urgency, shape future commitments and boundaries.

Practical Filters for Spotting Misaligned Offers

While your questions give you a solid decision process, you still need fast, practical filters that flag misaligned offers before you burn analysis time on them.

Limit how many deals you review each month; constraint sharpens deal evaluation. For every offer, quickly estimate three numbers: hours, profit, and strategic upside. If any looks weak, discard.

Cap your deal reviews. For each offer, estimate hours, profit, and upside—if one’s weak, walk away.

Use benchmarks from your history: reject anything below your median hourly return or with unclear downside. Create a red‑flag list: rushed deadlines, confusing terms, backloaded pay, or no written scope.

Two red flags? Pass. To check bias, write a one‑sentence prediction if it fails, then ask, “Would I take this if the upside were smaller?”

Finally, log each rejection and its opportunity cost in lost time, money, and focus.

Learning to Trust Yourself More Than the Deal

Certainty in deal-making isn’t a feeling; it’s a skill you build by measuring how often your initial read beats the promise on paper. You treat each decision like an experiment: log your intuition, the deal terms, and the outcome.

After ten or twenty deals, patterns appear. You’ll see when you underweight red flags or overvalue prestige.

Use self awareness strategies and emotional intelligence to separate signal from noise:

- Track your mood, energy, and FOMO before reviewing terms.

- Quantify risks, upside, and alignment on a simple 1–5 scale.

- Run a pre-mortem: list specific ways this deal could disappoint you.

- Ask, “What would I advise a friend?” and record that answer.

- Delay commitment 24 hours, then re-score with fresher eyes today.

Conclusion

When you treat each “good deal” as an experiment, you start collecting data on what genuinely improves your life versus what just triggers your scarcity bias. You notice patterns, refine your filters, and adjust. Over time, you’ll walk away from 99% of offers with the calm of a scientist closing a lab notebook. And the one percent you keep? Those aligned choices feel so right they might as well bend the laws of economics themselves.