How I Stopped Letting Sales Control My Spending

You can break free from sale-induced spending by creating a shopping list before every trip and sticking to it—no matter how tempting those red clearance signs look. Try the 30-day rule: add “must-haves” to a wishlist and wait (you’ll forget about 80% of them). Focus on cost-per-use instead of discount percentages, because a 50%-off item you’ll never use is still money wasted. These simple strategies help you spend intentionally rather than impulsively, and there’s more to discover about outsmarting retail tricks.

Key Takeaways

- Recognize psychological tactics like scarcity and loss aversion that retailers use to trigger impulse purchases and urgency.

- Create a prioritized needs-based shopping list and check every sale item against it before buying.

- Implement a 30-day waiting period for non-essential items to distinguish genuine needs from fleeting impulses.

- Evaluate true value by calculating cost-per-use rather than focusing on discount percentages or sale prices.

- Ask yourself if you’d buy the item at the sale price without the discount label.

Recognizing the Psychological Tricks Retailers Use to Make Us Buy

Before I could control my spending, I’d to admit something kind of embarrassing: stores were playing me like a fiddle.

They’d slap “ONLY 3 LEFT!” on a product, and suddenly I *needed* it—even though I didn’t want it five minutes earlier. That’s the scarcity principle doing its thing, making you panic-buy because your brain hates missing out.

Or they’d show the original price crossed out next to the sale price. Your brain sees that difference and screams, “You’re *losing* money if you don’t buy this!” That’s loss aversion messing with you.

Here’s the truth: these tricks work because they’re designed to bypass your logical brain entirely.

Retailers even use color psychology to influence your perception—reds and oranges create urgency while blues build trust, all without you consciously noticing.

Once I recognized these patterns, though? Game over for the retailers.

I started seeing sales for what they really were—marketing tactics, not actual emergencies.

The Wake-Up Call That Changed My Shopping Habits

My wake-up call came when I opened my credit card statement and literally said “oh no” out loud like a sitcom character.

That credit card statement moment when you audibly gasp at your own spending choices like you’re watching a horror movie.

There it was—$847 spent on “amazing deals” I couldn’t resist.

The worst part? I couldn’t remember half of what I’d bought.

That moment sparked my journey toward shopping awareness. I realized that sales were controlling me, not the other way around.

Every “50% off!” email had me clicking faster than I could think, zero financial mindfulness involved.

So I made a choice—I’d stop letting discounts dictate my decisions.

It wasn’t about never shopping again (let’s be realistic). It was about buying with intention instead of impulse.

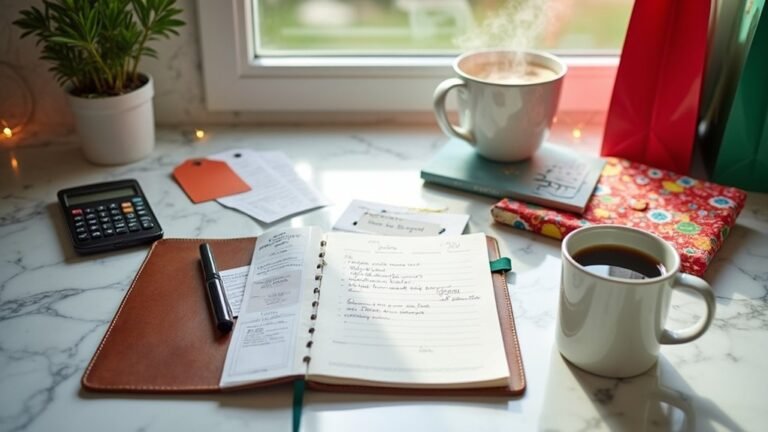

I started tracking my purchases for a few weeks, logging when and where I bought things, and the patterns that emerged were embarrassing—late-night scrolling sessions and post-work emotional spending binges dominated my credit card history.

And honestly? That shift changed everything.

Creating a Needs-Based Shopping List Before Every Purchase

After my credit card disaster, I knew I needed a system—something foolproof that would stop me from impulse-buying bath bombs I definitely didn’t need (even at 60% off, Karen).

So I started doing a needs assessment before every shopping trip—yes, every single one.

Here’s how it works: Before you even grab your wallet, write down what you actually need (not what the email ad says you need).

Then comes budget prioritization—ranking items by importance, like groceries over decorative throw pillows.

I keep this list on my phone, and it’s honestly saved me hundreds.

The best part? When I see those flashy sale signs now, I just check my list.

If it’s not there, it stays on the shelf.

No guilt. No FOMO. Just freedom.

I also started translating prices into hours of work to assess whether each item was really worth that chunk of my life.

The 30-Day Rule That Eliminated My Impulse Buying

The concept sounds almost too simple to work, but trust me—this little trick has been my secret weapon against buyer’s remorse.

When I see something I want, I add it to a wishlist and wait thirty days before buying it. That’s it.

Here’s what happens during your 30 day challenge: you either completely forget about the item (which means you never really needed it), or you still want it after a month—proving it’s worth the money.

This waiting period does wonders for impulse control. Those flash sales that used to make me panic-buy? They don’t work anymore because I’ve trained myself to pause first.

The method works by creating friction between desire and purchase, which transforms reactive spending into deliberate decision-making.

The best part? About 80% of my “must-haves” turn out to be totally forgettable.

Learning to Calculate Real Value Instead of Percentage Discounts

Why does a 70% discount feel like winning the lottery, even when you’re buying something you’d never pay full price for?

That’s discount psychology messing with your brain—and it got me too.

Here’s my value assessment shift that changed everything:

- Compare the sale price to similar items at regular price elsewhere (not to the inflated “original” price on the tag)

- Ask yourself: would I pay this amount if there was no sale sign?

- Calculate cost-per-use instead of just looking at the discount percentage

Suddenly, that $200 jacket marked down to $60 wasn’t such a steal—similar jackets were $55 everywhere else.

The real win? Buying things you actually need at fair prices, not collecting “amazing deals” that clutter your closet.

I started using unit pricing to compare products by their actual cost per measure, which revealed that many “sale” items actually cost more than alternatives when you do the math.

That’s the actual lottery worth playing.

Building New Habits That Prioritize Financial Goals Over Bargains

Once I realized chasing discounts was sabotaging my actual financial goals, I’d to rewire my entire relationship with money—and honestly, it felt weird at first.

Mindful spending became my new thing. Before buying anything—even stuff marked 70% off—I’d pause and ask myself: “Does this actually move me closer to my goals, or am I just excited about saving money?”

(Spoiler: usually the latter.)

I started habit formation by setting up automatic transfers to my savings account on payday. That way, my financial goals got paid first, before Target could tempt me with their clearance endcaps.

The shift wasn’t instant. Some days I’d still feel that familiar FOMO when friends texted about sales.

But slowly? My brain stopped seeing “discount” as permission to spend.

It started seeing it as noise.

I even began tracking my spending patterns for a month to see exactly where sale purchases were actually adding up versus what I truly needed.

In case you were wondering

How Do I Resist Sales When Shopping With Friends Who Encourage Spending?

Set boundaries before shopping by acknowledging your spending triggers. You can resist peer pressure by suggesting window shopping only, bringing limited cash, or simply saying “I’m on a budget.” Real friends’ll respect your financial goals and won’t push unnecessary purchases.

What Apps or Tools Can Help Track Whether Sales Are Genuine Discounts?

You’ll love Honey, CamelCamelCamel, and Keepa for price comparison and discount tracking. They’ll reveal price histories, expose fake markups, and confirm whether you’re getting real savings before you click “buy now” on those tempting deals.

How Do I Handle Guilt From Missing Out on Limited-Time Deals?

Reframe your guilt management approach by remembering that sales repeat constantly. Use FOMO strategies like waiting 24 hours before purchasing—you’ll realize most “limited” deals return. Focus on your financial goals, not artificial scarcity tactics retailers create.

Should I Unsubscribe From All Retail Emails and Marketing Notifications Completely?

Yes, an email detox works wonders. Think of marketing notifications as slot machines—designed to trigger spending urges. Unsubscribe from your biggest shopping triggers first, then gradually remove others as you build healthier habits and regain control.

How Do I Explain My New Shopping Habits to Family During Holidays?

Be honest about your holiday budgeting priorities and set clear boundaries early. Explain you’re managing finances differently now, and family expectations need adjusting. Suggest meaningful alternatives like experiences or homemade gifts that don’t strain your budget.

Conclusion

You’re not climbing out of the sales trap overnight—you’re building a ladder, one smart choice at a time. And honestly? That’s exactly how it should work. You’ve got the tools now: the waiting periods, the value calculations, the lists that keep you honest. Some days you’ll nail it, some days you’ll slip (we all do), but you’re done letting bright red tags make decisions for your wallet. That’s what matters.