The Shopping Triggers You Need to Recognize

You probably think you’re in control when you shop, but your emotions, environment, and even the way prices are displayed quietly steer your choices. Stress, boredom, and subtle “limited time” cues can push you to spend more than you planned, often without noticing. Research shows these triggers are systematic, not random. Once you recognize the patterns, you can start changing them—yet most people never spot the three most expensive ones you face every week.

The Emotional States That Sabotage Your Spending

When you feel stressed, lonely, bored, or inadequate, your brain quietly nudges you toward spending because it’s wired to seek quick relief from discomfort.

Stress, boredom, or loneliness don’t crave stuff—they crave soothing, and spending feels like instant relief.

Those moods heighten your sensitivity to rewards and weaken self-control. You’re not chasing the item; you’re chasing relief. Studies show negative emotions increase impulse buying, especially online, where friction is low.

Emotional spending temporarily soothes anxiety, shame, or emptiness by giving you a sense of control, identity, or connection. But the relief fades and regret, guilt, or new financial stress replaces it, reinforcing the emotional loop.

To interrupt it, label the feeling precisely: “I’m lonely,” “I’m depleted,” not “I need something new.” Naming the emotion activates your brain’s prefrontal cortex, cooling the urge and creating space to choose a non-spending response.

Marketing Tactics That Quietly Nudge You to Buy

Even if you think you’re making rational choices, marketers quietly shape your behavior long before you hit “checkout.”

Retailers use behavioral science—anchoring, scarcity, social proof, and loss aversion—to steer your attention, distort your sense of value, and shorten the time you spend deliberating.

You’re shown a high “original” price first so the next offer feels cheap, even if it’s average. That’s anchoring plus discount allure.

Limited-time banners and countdown clocks use urgency tactics to narrow your options and push you toward impulse commitments.

“Only 3 left” messages tap your fear of missing out, not your actual needs.

Star ratings, “bestseller” tags, and review counts signal what “people like you” choose, nudging you to follow the herd.

Recognizing these patterns lets you pause, question, and choose deliberately.

Environmental Cues That Turn Browsing Into Buying

Subtle details in a store or website—lighting, music, layout, color, scent, temperature—quietly shift you from “just looking” to “I’ll take it.”

Research in consumer psychology shows that warm lighting and slower music keep you browsing longer, while wide aisles and clear sightlines make you feel more in control and more willing to explore.

When you walk in, your brain quickly scans for cues of safety and reward. A deliberate store layout guides your path past high-margin items, using focal displays to slow your pace.

Online, endless scroll and recommendations mimic that guided wandering. Sensory stimulation—subtle scents, soft textures, slightly cooler air—boosts attention and makes leaving feel premature.

To counter it, briefly step away, change aisles or tabs, and ask, “Would I still buy this?”

Social Pressure and Comparison Shopping Traps

Environmental cues nudge you on your own; social forces push harder because they threaten your status and belonging. You don’t just buy; you match, signal, and protect identity.

Peer influence shows up when friends “recommend” luxury upgrades or post hauls that make your current stuff feel inadequate. Social media multiplies this effect, turning every scroll into a silent comparison game that stokes status anxiety and urgency.

Every scroll becomes a quiet competition, turning friends’ “recommendations” into fuel for status anxiety.

You’re most vulnerable when you’re unsure what’s “enough” or fear falling behind. Notice how often purchases follow subtle social comparisons:

- You upgrade after seeing a colleague’s newer version of what you own.

- You buy “for the photo,” not for real use.

- You overspend on gifts to avoid seeming cheap, compared with how you actually value that relationship today.

Mindset Shifts to Regain Control Over Your Purchases

Once you see how powerful these triggers are, the next step is shifting your mindset so you’re not reacting on autopilot every time something tempts you.

Start by separating wanting from deciding. Research shows a brief pause disrupts impulse loops, so insert a 24-hour rule before nonessential buys. During that pause, ask, “What problem does this solve, and is there a cheaper fix?”

Shift your identity from “bargain hunter” to “intentional allocator of money and attention.” Conscious spending means you actively choose what to fund and what to ignore, based on your real values, not moods.

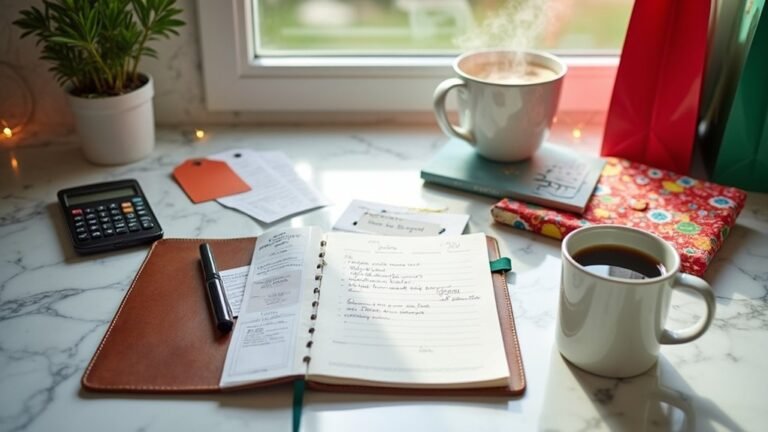

Use simple budgeting techniques—like fixed spending buckets and weekly review—to give every dollar a job. You’re training your brain, not restricting it. Over time, urges feel less urgent.

Conclusion

When you spot your triggers—like stress, clever scarcity cues, or that “everyone’s buying it” pressure—you stop shopping on autopilot and start choosing with intention. You pause, notice your emotions, and question the marketing hooks. You adjust your environment and mindset so spending aligns with your values. Each conscious decision is like tightening a loose bolt on your financial life—small, deliberate, and powerful—until your purchases genuinely reflect who you are and what you care about.